It is crucial to have rapid and simple access to financial resources in the fast-paced world of today. We’ll give over all the information you require about Manappuram personal loan details in this article. One of the most widely used methods for addressing immediate financial problems is through personal loans. Customers can get personal loans from Manappuram Finance, a well-known NBFC in India, at affordable interest rates.

Manappuram Finance Limited is one of the largest non-banking financial companies in India that offers a variety of financial services, including gold loans, business loans, personal loans, and housing loans. A personal loan from Manappuram Finance can be used to meet any financial requirement, including medical emergencies, wedding expenses, home renovation, and education expenses.

What is Manappuram Personal Loan?

Manappuram Personal Loan is an unsecured loan offered by Manappuram, one of India’s largest non-banking financial institutions, Manappuram Finance Limited, offering various financial services like gold loans, business loans, personal loans and mortgage loans. A personal loan from Manappuram Finance can be used to cover any type of financial need, including unexpected medical expenses, wedding expenses, remodeling expenses and educational expenses. Which can be acquired for various personal reasons. These loans are given on the basis of borrower’s income, credit score and repayment capacity. The loan amount can be repaid in easy EMIs over a specified period. Where does Manappuram Personal Loan offer flexible repayment options and competitive interest rates? We will see that here in this article

Features and Benefits of Manappuram Personal Loan

Loan amount

manappuram finance personal loan range from Rs. 20,000 to Rs. 10 lakh, depending on the borrower’s creditworthiness and repayment capacity.

Repayment tenure

The repayment tenure for Manappuram personal loans ranges from 12 months to 36 months, giving borrowers the flexibility to choose a repayment tenure that suits their needs.

Interest rates

Manappuram personal loan interest rates start at 13.99% p.a. The interest rate offered to a borrower is determined based on their credit score, repayment capacity, and other factors.

Processing fees

Manappuram charges a processing fee of up to 3% of the loan amount, which is deducted from the loan disbursal amount.

Prepayment charges

Manappuram does not charge any prepayment penalty if a borrower decides to repay the loan before the end of the repayment tenure.

Eligibility criteria for Manappuram personal loans

An applicant for a Manappuram personal loan must satisfy the following requirements:

- The borrower must reside in India.

- The borrower’s age must fall between 21 and 60.

- The borrower needs a reliable source of income.

- The borrower must to be in good credit score.

Documents Required for Manappuram Personal Loan

The documents needed to apply for a Manappuram personal loan include the following:

- Aadhaar, PAN, a passport, a voter ID, or a driver’s licence can all be used as identification proof.

- Aadhar cards, passports, voter IDs, or licences can all be used as proof of address proof.

- income proof documentation, such as pay stubs, bank records, or tax returns.

- Recent passport-size photos of yourself

How to Apply manappuram personal loan

To apply for a Manappuram personal loan, follow these steps:

- Go to the personal loans area of the Manappuram Finance Limited website.

- Give your personal and financial information on the loan application form.

- Upload every necessary document, such as your KYC records, income tax returns, and residency documents.

- Read the terms and conditions before submitting the application.

- A representative from Manappuram will be in touch with you to confirm your information and go over the loan offer.

- The loan amount will be disbursed to your bank account following the verification process.

As an alternative, you could apply for a personal loan in person by going to a branch in Manappuram. To ensure a smooth application procedure, don’t forget to include any necessary documentation.

Pros and Cons of manappuram personal loan

| Pros | Cons |

|---|---|

| Quick Disbursal: Manappuram personal loans are processed quickly, and the loan amount is disbursed to the borrower’s bank account within a short period of time, usually within a few hours to a day. | Higher Interest Rates for Some Borrowers: Manappuram offers cheap interest rates in general, however some borrowers with bad credit ratings or histories may be subject to higher rates. |

| Flexible Repayment Options: Manappuram offers flexible repayment options with longer tenures, which can range from 12 to 60 months. This helps borrowers to manage their finances and repay the loan on time without any stress. | Strict Eligibility Criteria: Manappuram has strict eligibility criteria for personal loans, and borrowers must meet certain income and credit score requirements to be eligible for a loan. |

| No Collateral Required: Manappuram personal loans are unsecured, which means that borrowers do not have to pledge any collateral, such as property or gold, to avail the loan. | Penalties for Late Payment: Manappuram charges a penalty fee if borrowers fail to make the loan repayment on time, which can increase the overall cost of the loan. |

| Minimal Documentation: The documentation process for a Manappuram personal loan is simple and straightforward, and requires minimal paperwork. | Limited Loan Amount: Manappuram personal loans are a available for a limited amount, and borrowers may not be able to avail a larger loan if they require a higher amount. |

| Competitive Interest Rates: Manappuram offers personal loans at competitive interest rates, which are usually lower than those offered by credit cards or other lending institutions. | Hidden Charges: While Manappuram offers transparent loan terms and conditions, borrowers should be aware of any hidden charges, such as processing fees, foreclosure charges, or prepayment charges, that may be applicable. |

Processing Fees and Charges for Manappuram Personal Loan

Manappuram Finance Limited charges certain processing fees and charges for their personal loans, which are as follows:

| Processing Fees : | Up to 2% of the loan amount may be charged by Manappuram as a processing fee, which is subtracted from the loan disbursal amount. This cost is not returnable. |

| Late Payment Charges: | Manappuram imposes a penalty cost, which is often a percentage of the outstanding loan balance, if a borrower fails to make the loan repayment on schedule. The penalty cost may be between 1% and 3% of the total amount of the outstanding loan. |

| Prepayment Charges: | Manappuram charges a prepayment fee of up to 4% of the outstanding loan amount if the borrower wants to prepay the loan before the completion of the loan tenure. This fee is not applicable if the borrower chooses to prepay the loan after paying at least 6 EMIs. |

| Foreclosure Charges: | If a borrower’s cheque bounces due to insufficient funds or any other reason, Manappuram charges a cheque bounce fee, which is usually a fixed amount. The cheque bounce fee can range from Rs. 500 to Rs. 1,000, depending on the loan amount and other factors. |

| Cheque Bounce Charges: | If a borrower’s cheque is bounced due to insufficient funds or any other reason, Manappuram charges a cheque bounce fee of up to Rs. 500 per instance. |

It is important to read the terms and conditions of the personal loan agreement carefully and understand all the fees and charges associated with the loan. Borrowers should also inquire about any other applicable fees or charges before availing a personal loan from a Manappuram representative.

Repayment Options for Manappuram Personal Loan

Customers of personal loans from Manappuram Finance Limited have access to a variety of customizable repayment alternatives. The available repayment options are shown below:

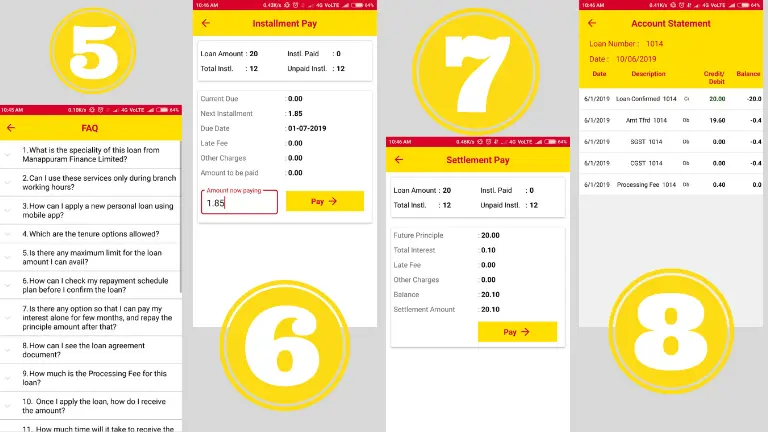

| EMI (Equated Monthly Installments): | EMI is a popular method of repaying personal loans. Borrowers who choose this option must pay a predetermined amount from their bank account each month in order to repay their loan. The EMI sum includes both the loan’s principle and interest payments. The EMI amount is calculated using the loan amount, interest rate, and loan period. |

| ECS (Electronic Clearing Service): | For borrowers who have a savings or current account with any bank, ECS is a practical choice. With this option, borrowers can designate a specific date each month for Manappuram to automatically deduct the EMI amount from their bank account. |

| Post-Dated Cheques (PDCs): | Borrowers can also give post-dated cheques for the EMI amount to Manappuram. The cheques are deposited on the due date every month for loan repayment. |

| Online Payment: | Manappuram also provides an online payment option for borrowers to make their EMI payments through the company’s website or mobile app. Borrowers can link their bank account or credit/debit card to make online payments. |

It is important for borrowers to choose a repayment option that suits their financial situation and ensures timely repayment of the loan. Late payment or defaulting on the loan can result in penalties and affect the borrower’s credit score. Borrowers should also consider the loan tenure and interest rate while choosing a repayment option.

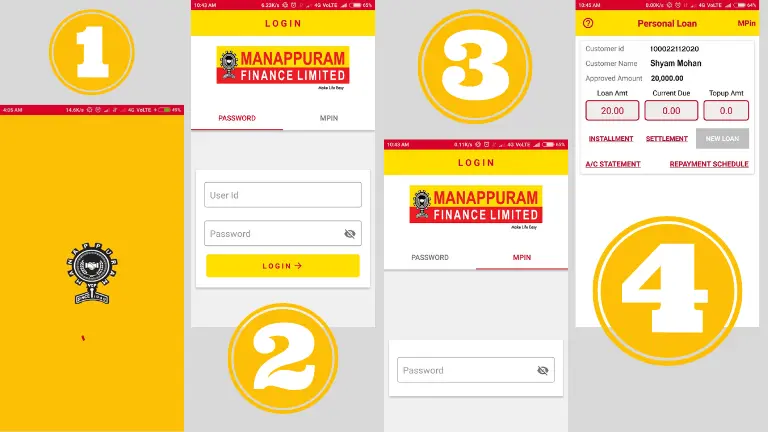

Manappuram personal loan app details

Manappuram Pre Approved Digital Personal Loan

Get an pre-approved personal Loan up to ₹2 Lakh with the Manappuram Personal Loan app, Our Annual Percentage Rate (APR) varies from 18% to 33%* and you can choose a wide range of repayment options starting from 24 to 36 months with the processing fee of ₹3%

#Personal Loan Feature & Benefits

> Loan Amount – Up to ₹2Lakh

> Interest Rate – Starting from 18% – 30% p.a

> EMI Options – 24 to 36 Months

> 100% digital process on Manappuram personal loan app

> Instant money transfer in your bank account by app

> No security deposits

Manappuram personal loans guide by video

Manappuram personal loan customer care number

| Manappuram Finance, Land Line: | 0487 3050454,308 |

| Email: | digitalpl@manappuram.com |

| WhatsApp: | +91 – 7594999984 |

| Tall Free Number: | 1800-420-22-33 (24×7) |

Manappuram Personal Loan – FAQs

-

What is the Interest Rate offered on Manappuram Personal Loan?

Manappuram Personal Loans come with an interest rate starting from 12% p.a.

-

What is the minimum and maximum age limit for getting a Personal Loan from Manappuram?

The age eligibility is minimum 21 years and a maximum of 60 years at the time of loan maturity.

-

What is the Processing Fee for Manappuram Personal Loan?

The processing fee is 3%-6% of the loan amount plus GST. Processing fees usually depends on the loan amount and the type of loan

My Honest Conclusion

In conclusion, Manappuram Personal Loan provides borrowers in need of immediate cash with a dependable and practical financing solution. Through my research and analysis, I realised that Manappuram, a reputable name in the banking sector, offers personal loans with affordable interest rates and flexible payback options.

The accessibility of the Manappuram Personal Loan is one of its main benefits. The easy application procedure can be finished online, which helps applicants save a lot of time and work. Manappuram also offers a broad range of branches, which makes it simple for borrowers to access their services and get specialised assistance if necessary.

The quick approval and funding disbursement of Manappuram Personal Loan is another noteworthy aspect. Their quick verification procedure guarantees that borrowers can obtain the loan amount on time, which is very helpful in emergency financial situations.

Manappuram also provides affordable interest rates that are adapted to each borrower’s specific requirements and capacity for repayment. This guarantees affordability and facilitates efficient money management on the part of borrowers. Additionally versatile are the loan tenure options, which let borrowers select a repayment schedule that works with their budget.

The Manappuram Personal Loan stands out for having little documentation requirements, which makes the application process easier for borrowers. This makes it simpler for people with little documentation or limited time to apply for the loan.

Finally, Manappuram is known for its outstanding consumer service. Throughout the loan application process, their committed team of specialists is committed to offering support and direction. Customers will have a great borrowing experience because they are always there to address any questions or issues.

Before applying for a personal loan, consumers should carefully assess their financial condition and ability to repay. In addition to incurring additional fees, missing loan installments might harm one’s credit rating.

Overall, as a blogger, I would advise those looking for a dependable and practical financing alternative to consider Manappuram Personal Loan. Manappuram establishes itself as a reliable option for personal loans thanks to their reasonable interest rates, quick approval process, flexible repayment terms, and exceptional customer service.

Thank you for reading this artical.